SG×HK Stablecoin Rail: The Compliant Fast Lane for Cross-Border Payments

This piece explains how MetaComp (Singapore) and OSL (Hong Kong) are building an interconnected digital-asset corridor to make stablecoin cross-border payments faster, cheaper, and more transparent while advancing RWA tokenization. By combining institutional liquidity with strong compliance standards, the partnership aims to reduce slippage and fees, enable fiat-to-stablecoin on-ramps, and support compliant issuance of tokenized assets. The article also outlines practical steps for remittances, the benefits of audited stablecoins like USDC, and the key risks to watch—chiefly regulatory shifts and operational complexity—so teams can adopt stablecoin rails confidently across Asia.

Asia's Finance Fusion: How to Tap into Stablecoin Cross-Border Payments

Have you ever waited days for a wire transfer to clear, only to get hit with hefty fees? Imagine a world where money zips across borders like a quick text message. It's surprising that cross-border payments cost the global economy up to $120 billion annually in fees, according to the Bank for International Settlements (BIS) (2023). For Web3 enthusiasts exploring real-world assets (RWAs) and stablecoins, traditional systems often feel outdated and restrictive, slowing down innovation in Asia's dynamic markets. But MetaComp and OSL, two powerhouse OTC (over-the-counter, meaning direct trades without exchanges) providers, are teaming up to change that. In this post, you'll learn how their partnership promotes stablecoin flows and RWA finance, so you can navigate this shift for smoother, compliant transactions. Picture it as two old friends linking arms to pave a faster path—simple, yet game-changing.

The Partnership Unveiled: Bridging Singapore and Hong Kong

First, let's break down the alliance. MetaComp, based in Singapore, and OSL, from Hong Kong, announced their collaboration on September 8, 2025, to build a connected ecosystem for digital assets. They're creating the Singapore-Hong Kong Interconnected Centre, blending their strengths in compliance and liquidity.

Why does this matter? It challenges traditional finance by enabling efficient stablecoin—cryptocurrencies pegged to fiat like the USD for stability—cross-border payments and RWA tokenization, where real assets like bonds or real estate become digital tokens. According to Finextra (2025), this setup enhances liquidity and reduces slippage, making trades more reliable.

It's like merging two bustling markets into one seamless bazaar. A quick story: I once fumbled a cross-border send during a trip, watching fees eat my budget—like a comedy sketch gone wrong. You can get started by checking MetaComp's StableX platform, where you route stablecoins for low-cost transfers.

Boosting Stablecoin Payments: Speed and Compliance in Action

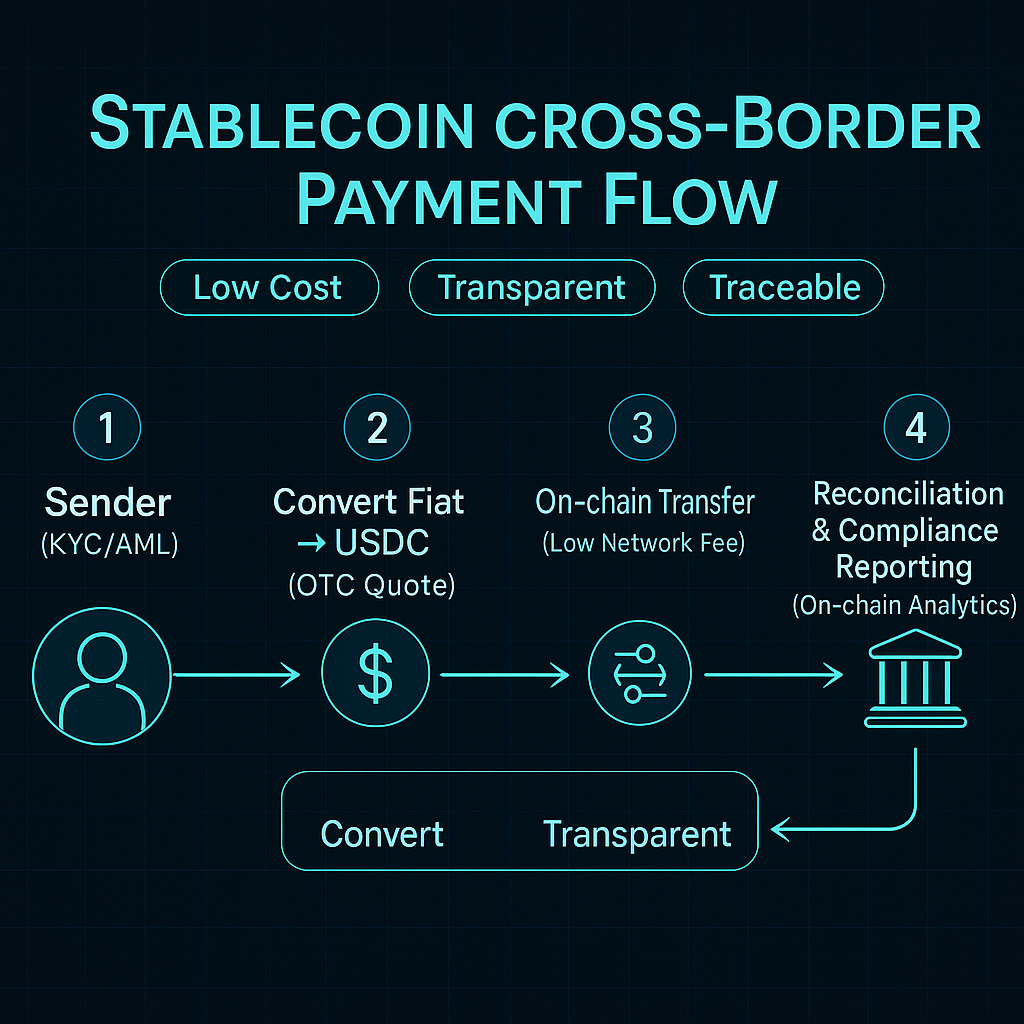

Next, the focus on stablecoins. The duo aims to co-develop infrastructure for payments between the two hubs, offering speed, transparency, and cost savings without skimping on rules.

The impact? Institutions and users gain from better pricing and institutional-grade services. Tin Pei Ling, MetaComp's Co-President, notes in Finextra (2025) that it sets "new benchmarks for compliance and innovation." This could streamline remittances in Asia, where high fees burden millions.

Observe this: during volatile times, stablecoins like USDC provide a steady bridge, as seen in recent outflows from banks. Try this when sending abroad: use OSL's network to swap fiat to stablecoins, ensuring AML checks via their shared tools.

Elevating RWA Finance: Tokenization Takes Center Stage

Therefore, RWAs get a spotlight. The partnership explores cross-listing tokenized assets, allowing buys with fiat or stablecoins under regulatory guardrails.

For example, a Galaxy Digital report (2024) projects RWAs unlocking trillions by blending TradFi with Web3, and this alliance accelerates that in Asia. It's almost funny—traditional banks plodding along while these players sprint ahead like caffeinated innovators. Practical tip: When investing, start with compliant platforms like Centrifuge for RWA tokens, verifying MAS or HK approvals.

Navigating Potential Hurdles

However, risks exist. Regulatory changes or tech glitches could slow progress, especially in evolving markets.

Acknowledge trade-offs: While efficiency rises, volatility in crypto persists. The BIS (2023) highlights challenges like settlement risks in stablecoin arrangements. Balanced takeaway: Diversify with audited stablecoins and monitor updates from MAS for safe engagement.

Wrapping Up the Alliance's Promise

In short, MetaComp and OSL's partnership fuses Singapore and Hong Kong's strengths to champion stablecoin payments and RWA finance, delivering liquidity, compliance, and efficiency that outpace traditional systems. This move democratizes access, cuts costs, and sparks innovation in Web3.

Echoing that frustrating wire wait, it's refreshing to see barriers crumble. I'd love to hear your cross-border tales—share in the comments which stablecoin you're using, or test a transfer and report back.

References

- Bank for International Settlements. (2023). Considerations for the use of stablecoin arrangements in cross-border payments. https://www.bis.org/cpmi/publ/d220.htm

- Finextra. (2025, September 8). Singapore's MetaComp and OSL team to build ecosystem for digital assets and tokenized finance. https://www.finextra.com/pressarticle/106945/singapores-metacomp-and-osl-team-to-build-ecosystem-for-digital-assets-and-tokenized-finance

- Galaxy Digital. (2024). Real World Assets: The Next Wave of Tokenization. https://www.galaxydigital.io/insights/research/real-world-assets-the-next-wave-of-tokenization