Nasdaq Embraces On-Chain Culture: How to Read the Proposal and Rethink the Capital Market

Nasdaq Embraces On-Chain Culture: How to Read the Proposal and Rethink the Capital Market

Nasdaq has asked the U.S. Securities and Exchange Commission (SEC) to allow tokenized versions of listed stocks and ETFs to trade on the same order book as their traditional counterparts. In plain English: same ticker, same market data, same surveillance—just a different post-trade rail if a participant opts for “token form.” According to Nasdaq (2025), the Depository Trust Company (DTC) would clear and settle those tokenized deliveries, with timing contingent on regulatory approvals and infrastructure readiness (Nasdaq, 2025, newsroom Q&A). For institutional product managers, exchange operators, compliance officers, and Web3 builders, this is a bridge between today’s market structure and on-chain rails. In this piece you’ll learn how the plumbing works, what it changes (and doesn’t), how it intersects with MiCA, HKMA, and MAS rules, and a practical playbook to prepare—without hype.

Introduction

Imagine tapping “buy” on your broker and choosing one of two lanes: settle in the traditional way or receive the same share as a token on a ledger. That’s the promise Nasdaq put before the SEC on September 8, 2025, proposing tokenized securities trading alongside traditional shares, under the same rulebook and surveillance. According to Nasdaq (2025), the aim is to modernize settlement while preserving core market protections (Nasdaq newsroom Q&A).

For our audience—institutional product managers, exchange operators, compliance teams, and Web3 builders—the “why now” is clear. Tokenized treasuries have climbed into the multi-billion-dollar range and broader on-chain RWA value (excluding stablecoins) is sizable, while stablecoins themselves sit in the hundreds of billions in circulation (RWA.xyz, 2025; DeFiLlama, 2025). The piece that follows unpacks the filing’s logic, clarifies DTC’s role, sketches regulatory guardrails (U.S./EU/HK/SG), and provides a practical implementation checklist. If the idea of “NBBO-safe tokenization” sounds like a paradox, consider this your field guide—with an occasional light analogy to keep the circuits cool.

Definitions & Context

- Tokenization: recording claims on an asset as tokens on a shared ledger; here, it means a stock/ETF share represented in “token form” while remaining within existing exchange rules (Nasdaq, 2025, newsroom Q&A).

- RWA (Real-World Assets): financial or real assets represented on a blockchain (e.g., treasuries, funds, real estate) (RWA.xyz, 2025).

- Stablecoin: a crypto-token designed to maintain a stable value (often 1:1 to a fiat currency), backed by reserves and subject to prudential expectations (BIS/FSB, 2023–2025).

- NBBO: National Best Bid and Offer—the best quoted bid and offer across U.S. markets.

- Reg SCI: the SEC’s systems compliance and integrity rule for high-availability market infrastructure.

- KYC/AML: know-your-customer / anti-money-laundering compliance processes.

- Tokenized T-bills: blockchain representations of short-term U.S. Treasuries, often wrapped via fund structures (RWA.xyz, 2025).

Snapshot (as of Sep 2025): industry trackers show multi-billion totals in tokenized treasuries and broader RWAs (ex-stablecoins), while stablecoins remain a large share of the on-chain monetary base (RWA.xyz; DeFiLlama, 2025). The exact figures shift daily, so treat them as directional.

What Nasdaq Actually Filed (and Why It Matters)

Explain. Nasdaq proposes that equity securities and ETPs can be traded in either traditional or tokenized form on the same Nasdaq order book. Orders are entered over existing connectivity; market-data feeds do not label “token vs. traditional”; surveillance is the same; fees don’t change; and trades flagged for tokenized delivery would still be processed through DTC—initially expected to remain T+1 in line with current U.S. settlement conventions (Nasdaq, 2025, newsroom Q&A).

Evidence. The proposal emphasizes preservation of the national market system’s integrity (e.g., NBBO), minimizing fragmentation by avoiding separate tokenization venues. The exchange also notes that DTC is building the post-trade stack needed for tokenized settlement (Nasdaq, 2025).

Example. Think of a well-known ETP like QQQ: an order marked for tokenized settlement would match like any other order in QQQ; the exchange would then convey the settlement instruction to DTC (Nasdaq, 2025).

Mini how-to. If you’re a broker-dealer: no new exchange connectivity; focus on (1) order flags, (2) back-office messaging to DTC, (3) record-keeping alignment, and (4) clear client disclosures on “token form.”

Transition. That brings us to the settlement plumbing: what DTC is actually doing—and what it isn’t.

The Settlement Rail: DTC’s Role and Project Ion Context

Explain. Under the proposal, DTC would maintain authoritative records and handle tokenized settlement as a service—much like today’s post-trade, but with a new “token form” lane. The goal is to preserve market integrity—same trade lifecycle, different delivery mechanism (Nasdaq, 2025).

Evidence. DTC’s parent (DTCC) has explored DLT for years via Project Ion, which operates a parallel production environment handling significant daily transaction volumes—a proof of institutional capability for evolving settlement workflows (DTCC, 2022–2023).

Example. In practice, your order hits Nasdaq, matches, and then—based on an order flag—the exchange transmits a “settle in token form” instruction to DTC. DTC completes delivery in token form (initially T+1), while core books remain synchronized (Nasdaq, 2025).

Mini how-to. For operations teams: map (1) order flags and FIX/OUCH changes, (2) DTC messaging for tokenized delivery, (3) reconciliation between token ledger, transfer agent, and customer sub-ledgers, (4) disclosures to clients on “token form” rights and risks.

Transition. But what’s the actual value to market quality?

Market Structure Benefits (Without Breaking the NBBO)

Explain. The “file-on-chain” vision often collides with fragmentation fears. Nasdaq’s design argues the opposite: price discovery stays centralized in the existing NMS; tokenization only appears in the post-trade “how it settles” step. That avoids splintering liquidity and keeps best-execution obligations clear (Nasdaq, 2025).

Evidence. According to the proposal, market-data feeds won’t tag tokenized shares differently; surveillance continues as usual, with FINRA and exchange oversight unchanged (Nasdaq, 2025).

Analogy. Think of it like choosing delivery for the same package: overnight or standard. The contents (rights) and storefront (order book) don’t change; only the courier does.

Example. Contrast with private tokenization pilots in money-market funds where tokens circulate in closed systems; useful, but detached from NMS quoting. Industry coverage notes institutional demand for tokenized funds as collateral and cash-management tools, but most run within institution-only stacks (Financial Times, 2025).

Mini how-to. For issuers and sponsors: keep investor communications consistent—if tokenized shares carry the same rights, say so plainly and back it with transfer-agent records. If rights differ (e.g., limitations), plan for distinct treatment and disclosures.

Transition. With the mechanism clear, let’s ground the scale with data.

The Data View: RWAs, Stablecoins, and What’s Growing

Explain. Tokenization isn’t starting at zero. As of September 2025, industry dashboards report multi-billion totals in tokenized treasuries and broader RWAs (ex-stablecoins), and stablecoin supply remains in the high hundreds of billions (RWA.xyz; DeFiLlama, 2025).

Evidence. Trackers and financial press report rising adoption of tokenized funds for treasury management and collateral workflows (Financial Times, 2025).

Example. BlackRock’s on-chain fund and a wave of tokenized treasuries already feed crypto-native liquidity workflows, a preview of how tokenized equities might be used for collateral in the future—subject to regulatory guardrails (Financial Times, 2025).

Mini how-to. For analytics teams: establish daily pulls from RWA.xyz and DeFiLlama; track growth in tokenized cash equivalents vs. risk assets; add a “tokenized settlement adoption” KPI once equity pilots begin.

Transition. How does the workflow actually look in a tokenized trade?

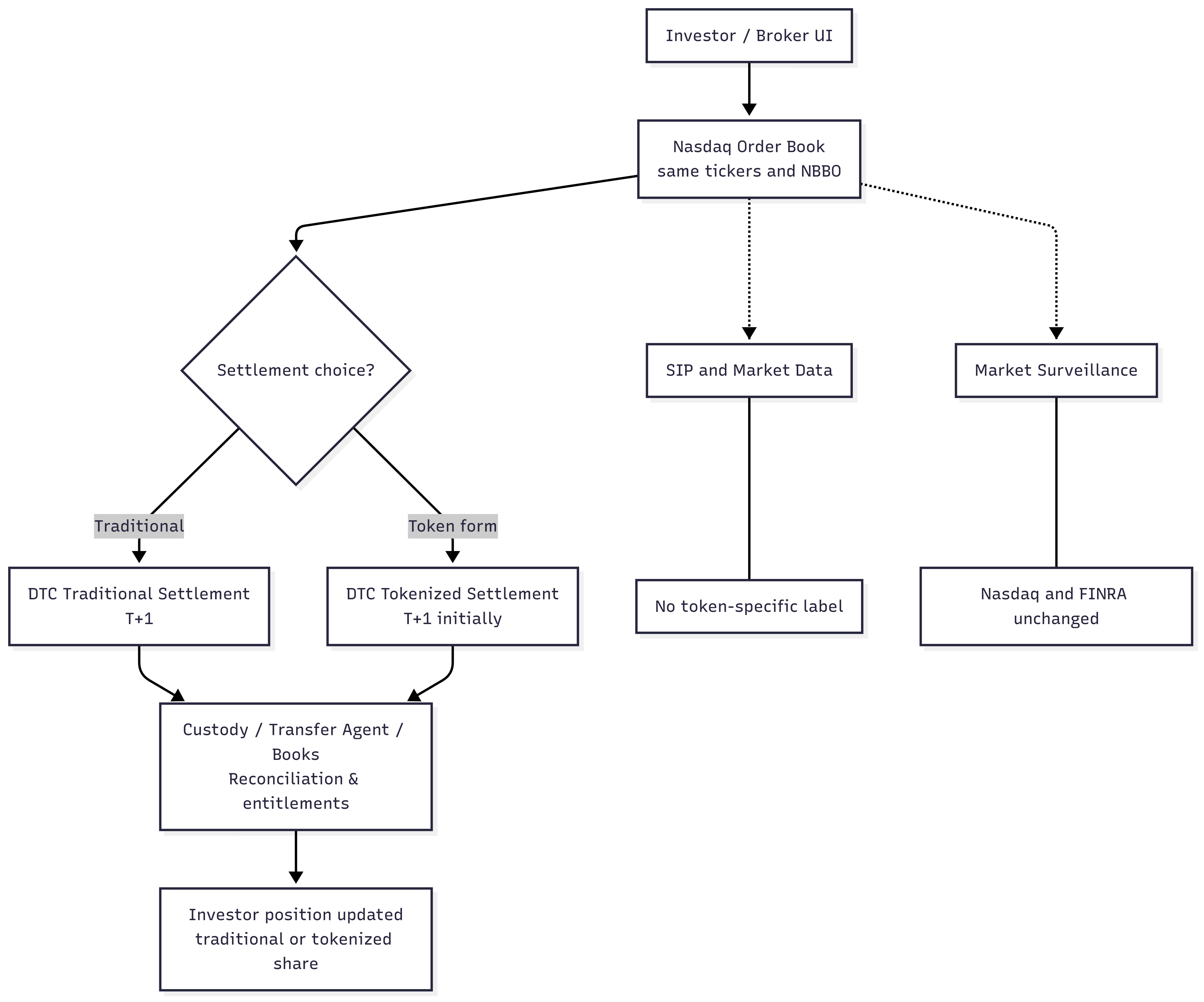

Architecture & Workflow (At a Glance)

How to read this: trading remains where it is (order book); tokenization is a delivery choice handled by DTC, not a separate trading venue (Nasdaq, 2025).

Transition. Let’s ground it with a concrete example from the filing.

Ecosystem Interoperability (Wallets, Custodians, Compliance)

Explain. If Nasdaq’s model proceeds, wallets and custodians need to support tokenized positions that mirror transfer-agent records; broker-dealers handle entitlements and corporate actions per normal processes; KYC/AML remains at the broker/custodian layer (Nasdaq, 2025).

Evidence. The proposal emphasizes unchanged market data, fee schedules, and surveillance—so firms can reuse most of their stack. Settlement choice is the variable (Nasdaq, 2025).

Example. A prime broker could custody tokenized shares with a qualified custodian that can safekeep both traditional and tokenized forms, while still reporting under existing regulations. Corporate actions would flow through the usual channels.

Mini how-to. Custody teams should inventory: ledger support, whitelisting controls, entitlements, and proof-of-reserves/holdings attestations compatible with transfer-agent records—so that “token form” never drifts from the canonical share count.

Regulatory & Risk Landscape (US/EU/HK/SG)

United States. The SEC must approve Nasdaq’s rule change. The agency has reiterated a basic principle: tokenized securities are still securities, subject to the same investor-protection rules (SEC, 2025, public statements). In parallel, Reg SCI, best-execution, market surveillance, and transfer-agent rules continue to apply.

European Union. MiCA rules for asset-referenced tokens (ARTs) and e-money tokens (EMTs) took effect in 2024, with ESMA guidance clarifying compliance expectations and transitional mechanics for stablecoins and service providers (ESMA, 2024–2025).

Hong Kong. The Stablecoin Ordinance came into force on Aug 1, 2025, with HKMA inviting license applications and signaling a path toward the first issuances under the regime (HKMA, 2025).

Singapore. MAS finalized its stablecoin framework in Aug 2023 for high-quality SGD/G10-pegged tokens, with detailed ongoing guidance for implementation (MAS, 2023).

Top risks/constraints.

- Operational synchrony — preventing divergence between token ledgers and transfer-agent records.

- Liquidity/fragmentation — ensuring tokenized settlement does not incent off-book trading or obscure NBBO.

- Policy shifts — standard-setter guidance is evolving; the BIS endorses tokenization potential within regulated “unified ledger” concepts while highlighting stablecoin and interoperability risks (BIS, 2023–2025).

Implementation Playbook (for Product, Ops, Compliance)

1) Readiness & design.

- Map today’s trade lifecycle and highlight only the parts that change (order flagging; DTC instruction; token custody) (Nasdaq, 2025).

- Confirm entitlement records remain canonical at the transfer agent/custodian; design reconciliations to detect drift (daily controls, exception queues).

2) Controls & disclosures.

- If token and traditional shares have identical rights, disclose parity clearly; if not, specify differences and investor suitability (Nasdaq, 2025).

- KYC/AML stays where it is—enhance screening for token withdrawals/deposits, wallet whitelists, and travel-rule data where applicable.

3) Custody & wallets.

- Choose qualified custodians that support token custody, segregation, and address-management controls.

- Mirror corporate-action handling in token form (record dates, entitlements, tax withholding) and test fail-scenarios (reversal, breaks).

4) Data/monitoring.

- Track fill ratios, slippage vs. NBBO, settlement-fail rates, token delivery times, and ledger-vs-TA reconciliation metrics.

- Add a “tokenized settlement adoption %” KPI per symbol; benchmark against RWA/treasury-token flows (RWA.xyz; DeFiLlama, 2025).

5) Policy alignment.

- U.S.: participate in the SEC comment process; maintain Reg SCI posture.

- EU: align with MiCA if your product touches ART/EMT definitions.

- HK/SG: study HKMA licensing and MAS stablecoin rules if your services intersect with issuance, custodial wallets, or transfer restrictions (ESMA; HKMA; MAS).

Pitfalls to avoid. Over-promising “24/7 equities” before market-hours policies change; treating token form as a different security without legal basis; neglecting reconciliations across ledgers.

Outlook / Scenarios (Next 6–12 Months)

Signals to watch. SEC comment letters and timeline on the Nasdaq filing; DTC milestones toward tokenized settlement; the first issuer applications (e.g., ETP sponsors); and whether other U.S. exchanges submit similar proposals (Nasdaq, 2025; industry coverage such as TechFlowPost, 2025).

Plausible scenarios.

- Base case: phased approval with pilot symbols; tokenized settlement limited to specific members first.

- Upside: quick integration once DTC switches on services; broader collateral use in prime finance and repo.

- Downside: delays if policymakers prioritize other crypto issues, or if operational tests surface reconciliation risks.

Falsification. If DTC’s infrastructure timeline slips materially—or if the SEC declines the rule change—the near-term “NMS-native tokenization” thesis weakens substantially (Nasdaq, 2025).

FAQs

Is this a new token exchange?

No. Nasdaq proposes using the same order book and surveillance. Tokenization appears at settlement via DTC—orders still contribute to the NBBO (Nasdaq, 2025).

Will tokenized trades settle faster than T+1?

Initially, no; the filing indicates tokenized trades handled by DTC would continue to settle T+1, subject to future evolution (Nasdaq, 2025).

Do tokenized shares have the same rights?

They can—if designed that way. Nasdaq stresses parity is essential; otherwise, they become distinct instruments with distinct disclosures (Nasdaq, 2025).

Does this change best execution?

No. Broker-dealers still owe best execution; trading remains in the same market structure (Nasdaq, 2025).

How does this fit global regulation?

It dovetails with jurisdictions building rules around tokenization and stablecoins (MiCA; HK’s Stablecoins Ordinance; MAS’s framework) (ESMA; HKMA; MAS).

Conclusion + Call to Action

Nasdaq’s proposal is pragmatic: keep markets where they are, let settlement evolve. If approved, it gives institutions a way to experiment with token rails without abandoning NMS safeguards—same tickers, same surveillance, same disclosures, new delivery option. The near-term job is operational: order flags, DTC hooks, custody, and reconciliation. The strategic job is cultural: explaining to boards and clients that “token form” doesn’t rewrite the rulebook; it modernizes the mailroom.

As you evaluate, remember three takeaways. First, the proposal is less revolution than integration—designed to preserve price discovery and investor protection. Second, the real work sits in post-trade and custody; get your controls and communications right. Third, policy momentum in the EU, Hong Kong, and Singapore suggests this isn’t a U.S.-only story.

If your team is exploring tokenized settlement, share what you’re piloting, what you’re stuck on, or what you’d like us to model next. The comments—and the order book—are open.

References

- Bank for International Settlements (BIS). 2023. “Blueprint for the Future Monetary System.” https://www.bis.org/publ/arpdf/ar2023e3.htm

- DTCC. 2022. “DTCC’s Project Ion Reaches New Milestone.” https://www.dtcc.com/news/2022/july/27/project-ion

- DTCC. 2023. “Project Ion: A Springboard to the Future.” https://www.dtcc.com/dtcc-connection/articles/2023/june/05/a-springboard-to-the-future

- ESMA. 2024–2025. “Markets in Crypto-Assets Regulation (MiCA): Guidance and Statements.” https://www.esma.europa.eu/esmas-activities/digital-finance-and-innovation/markets-crypto-assets-regulation-mica

- HKMA. 2025. “Stablecoin Issuers: Licensing Regime (in force 1 Aug 2025).” https://www.hkma.gov.hk/eng/key-functions/international-financial-centre/stablecoin-issuers/

- MAS. 2023. “MAS Finalises Stablecoin Regulatory Framework” (Aug 15). https://www.mas.gov.sg/news/media-releases/2023/mas-finalises-stablecoin-regulatory-framework

- Nasdaq. 2025. “Q&A: Nasdaq’s Proposal for Tokenized Securities” (newsroom explainer). https://www.nasdaq.com/newsroom

- RWA.xyz. 2025. “Global RWA Market Overview & Tokenized Treasuries.” https://app.rwa.xyz/

- DeFiLlama. 2025. “Stablecoins Dashboard.” https://defillama.com/stablecoins

- Financial Times. 2025. “Investors Pile into Tokenised Treasury Funds.” https://www.ft.com/

- TechFlowPost. 2025. “Nasdaq Embraces Tokenization: What Changes and What Doesn’t.” https://www.techflowpost.com/article/detail_28113.html

Sidebar: Callout

Stat to watch: tokenized U.S. treasuries have reached multi-billion scale, a useful proxy for readiness of institutional token rails (RWA.xyz, 2025).

Sidebar: Quick Comparison Table

| Feature | Traditional Share on Nasdaq | Tokenized Share on Nasdaq (Proposed) |

|---|---|---|

| Order book | Same | Same |

| Market data tag | None | None |

| Surveillance | Same (Nasdaq/FINRA) | Same (Nasdaq/FINRA) |

| Settlement | DTC (T+1) | DTC tokenized service (T+1 initially) |

| Investor rights | Canonical | Same if designed for parity |