How to Launch Renewable Energy RWA in China & Hong Kong

This piece explains how to turn renewable energy projects into compliant, investable tokens using the China–Hong Kong corridor. It demystifies tokenization, outlines why Hong Kong is “RWA-ready” (from government tokenised green bonds to the Project Ensemble sandbox for tokenised deposits), and shows a minimal architecture: an asset ledger for verified kWh data, a trading ledger for KYC’d investors, and a trusted bridge enforcing transfer rules and DvP settlement. You’ll learn why data integrity and clear legal characterisation matter most, how to start with a private placement and automated payouts, and what risks—liquidity, audits, sandbox limits—to manage early, drawing lessons from MAS’s expanding Project Guardian pilots.

From Sunlight to Securities: How to Launch Renewable Energy RWA in China & Hong Kong

Introduction

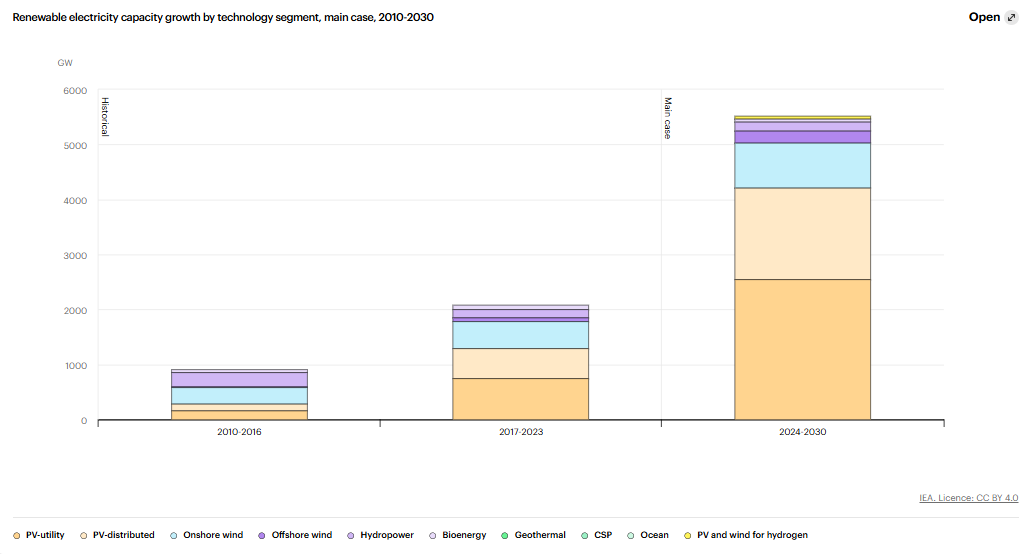

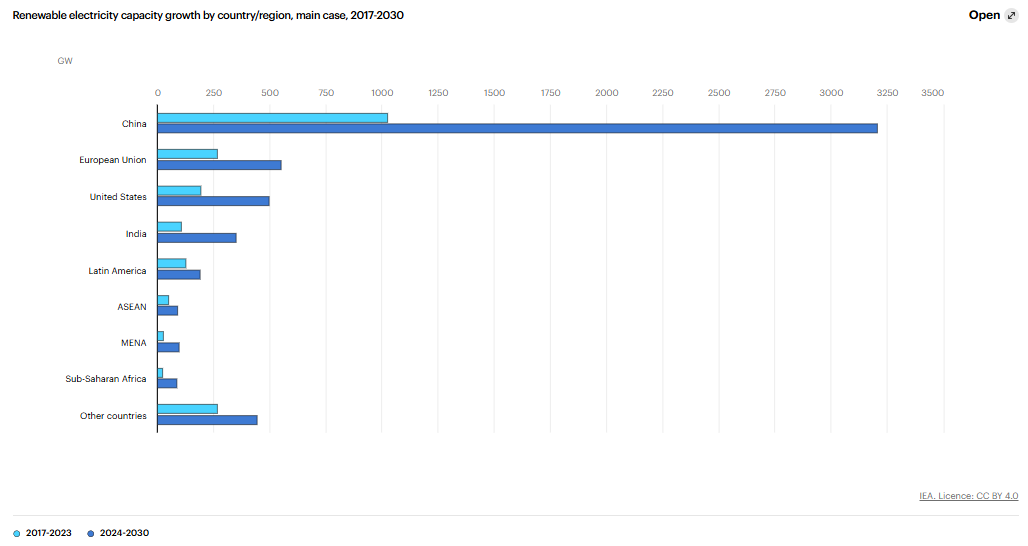

Have you ever tried explaining tokenization over dim sum and watched eyes glaze faster than a solar panel at noon? Here’s the friendly version: tokenization turns ownership or cash-flow rights of real-world assets (RWA) into programmable digital tokens. It’s surprising that global renewable additions are set to rise from 666 GW in 2024 to almost 935 GW by 2030—with solar and wind doing most of the work—according to the International Energy Agency (IEA, 2024) (link). For institutional risk and compliance teams in APAC, the challenge isn’t enthusiasm—it’s how to go from pitch deck to a compliant issuance. In this post, you’ll learn a practical China–Hong Kong playbook so your first renewable-energy token lands cleanly, settles safely, and speaks compliance from day one.

Section A — Why the China–Hong Kong corridor is “RWA-ready”

RWA here means off-chain assets like solar farms; an SPV (special-purpose vehicle) legally holds those assets; DvP (delivery-versus-payment) means tokens and money settle simultaneously. Hong Kong has already proven the capital-markets plumbing: the HKSAR Government’s tokenised green bond settled T+1 on a platform where on-chain records were legally definitive—comforting words to any auditor (HKMA, 2023) (link). Building on that, Project Ensemble is the HKMA sandbox for tokenised deposits—bank money represented as tokens—explicitly designed to test PvP and DvP settlement for tokenised assets (HKMA, 2024) (link). First: policy scaffolding. Next: live experiments. Therefore: lower execution risk for your pilot.

For example: If your SPV issues a solar-revenue note, tokenised deposits in the Ensemble Sandbox can align cash and securities movements in one workflow—less reconciliation, fewer settlement “maybes” (HKMA, 2024) (link). It’s like swapping walkie-talkies for a full-duplex intercom—everyone hears the same truth at the same time.

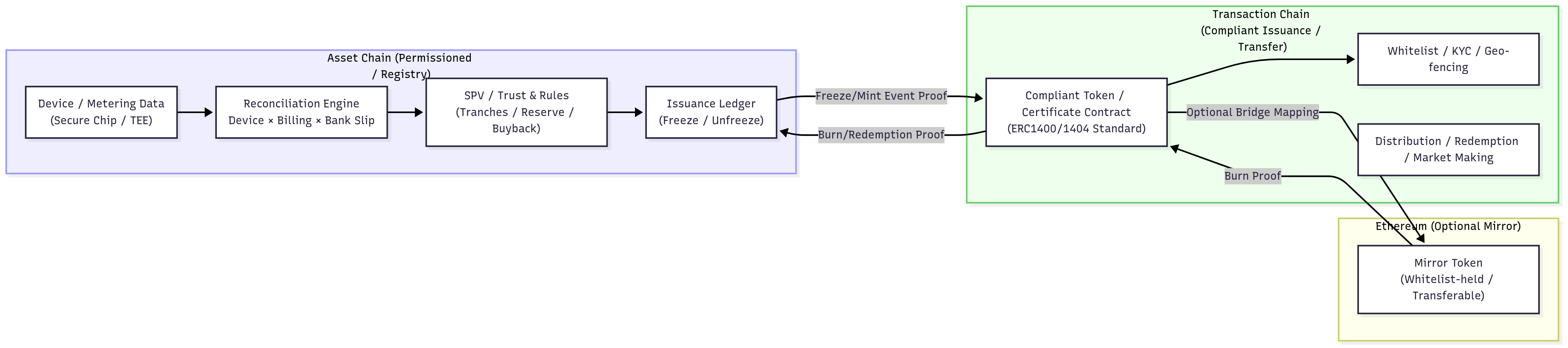

Section B — The minimal plumbing

Think “two ledgers, one bridge.” An asset ledger governs mint/burn tied to verified operations data (metered kWh, grid receipts). A trading ledger handles issuance and secondary transfers among KYC (know-your-customer) qualified investors. A trusted bridge synchronizes proofs and events, enforcing whitelist rules and transfer restrictions. Keep the token standard securities-friendly—transfer controls, lock-ups, and disclosure checkpoints built into the contract—so you automate what used to live in spreadsheets. Practical tip: start with a private placement to professional investors, DvP settlement in a controlled venue, and NAV signalling plus automated distributions baked into the token logic.

Section C — Data, measurement, and credibility loops

Tokenization doesn’t remove risk; it instruments it. Design data integrity before code: multi-source IoT readings, edge signatures, and periodic third-party audits so every kWh claim is defensible. Tie claims to recognized certification or metering regimes and schedule attestations the way you schedule coupon payments. Regionally, Singapore’s Project Guardian is widening trials across tokenised funds, deposits, and foreign-exchange legs, giving risk teams a growing library of policy-friendly patterns to borrow (MAS, 2024) (link). Translation: the controls already exist—you’re wiring them closer to the asset’s heartbeat.

Section D — A quick counterpoint

Yes, money and assets are converging, but not perfectly. Ensemble is a sandbox, not statute; liquidity will be earned, not assumed. However, the direction of travel is clear: Hong Kong has issued and settled digital green bonds under government auspices (HKMA, 2024) (link), and the IEA’s growth baseline suggests the pipeline of renewables will only get fatter (IEA, 2024) (link). To de-risk, go narrow before you go wide: professional investors only, discrete pools (one asset type per SPV), conservative lock-ups, and a named market-maker for price discovery.

Conclusion + Call to Action

In short, three moves matter most. First, ride proven rails: Hong Kong’s bond precedents and tokenised-deposit sandbox show DvP can be real, not theoretical. Next, treat data as collateral: metering, audits, and clear legal characterisation—debt vs. revenue-share—should be specified in the term sheet, not in footnotes. Finally, start small, learn fast: a private placement with automated payouts beats a grand launch with operational unknowns. If you could tokenise one asset this quarter—rooftop solar, EV charging, or storage—what would it be, and which control would you hard-code first? Try a scoped pilot and report back what surprised you most.

References

- Hong Kong Monetary Authority. (2023, February 16). HKSAR Government’s inaugural tokenised green bond offering. https://www.hkma.gov.hk/eng/news-and-media/press-releases/2023/02/20230216-3/

- Hong Kong Monetary Authority. (2024, August 28). HKMA launches Project Ensemble Sandbox to accelerate adoption of tokenisation. https://www.hkma.gov.hk/eng/news-and-media/press-releases/2024/08/20240828-3/

- Hong Kong Monetary Authority. (2024, February 7). HKSAR Government’s digital green bonds offering. https://www.hkma.gov.hk/eng/news-and-media/press-releases/2024/02/20240207-6/

- International Energy Agency. (2024, October 9). Renewables 2024: Electricity. https://www.iea.org/reports/renewables-2024/electricity

- Monetary Authority of Singapore. (2024, June 27). MAS expands industry collaboration to scale asset tokenisation for financial services. https://www.mas.gov.sg/news/media-releases/2024/mas-expands-industry-collaboration-to-scale-asset-tokenisation-for-financial-services