iPhone 17 Unleashed: How to Build Wealth in Web3 by Hoarding Coins

This article draws a parallel between Apple’s long-term brand loyalty and the crypto strategy of HODLing. Using the iPhone 17 launch as a metaphor, it highlights how holding Bitcoin has vastly outperformed consumer goods inflation, and extends the principle to stablecoins and RWAs, which can generate yield and stability in DeFi. While acknowledging risks such as overexposure and regulatory challenges, the piece emphasizes balanced portfolios, long-term patience, and compounding growth as the core of “Apple thinking” in Web3 investing.

iPhone 17 Unleashed: How to Build Wealth in Web3 by Hoarding Coins

Have you ever pondered the stark contrast between buying the latest gadget and investing in something timeless? With the iPhone 17's recent unveiling on September 9, 2025, featuring its ultra-thin design and advanced A19 chip, social buzz erupted around "Android thinking" versus "Apple thinking"—practicality against premium loyalty. Yet, gazing at that reveal, I spotted a profound parallel in crypto: the ultimate "Apple thinking" is hoarding coins, or HODLing, where you hold assets steadfastly amid volatility. For those immersed in Web3, real-world assets (RWAs), and stablecoins, market swings often provoke hasty trades, diminishing long-term potential. In this post, you'll discover how to adopt this mindset for steady accumulation, so you can foster enduring value in decentralized ecosystems. It's akin to tending a quiet garden, where seeds of patience bloom into abundance.

Embracing Apple Thinking: Long-Term Holding in Crypto

Apple thinking embodies a philosophy of sustained innovation and ecosystem loyalty, where users invest in the brand's reliability over fleeting features. In crypto, this translates to HODLing—clinging to assets like Bitcoin through cycles, trusting their foundational value.

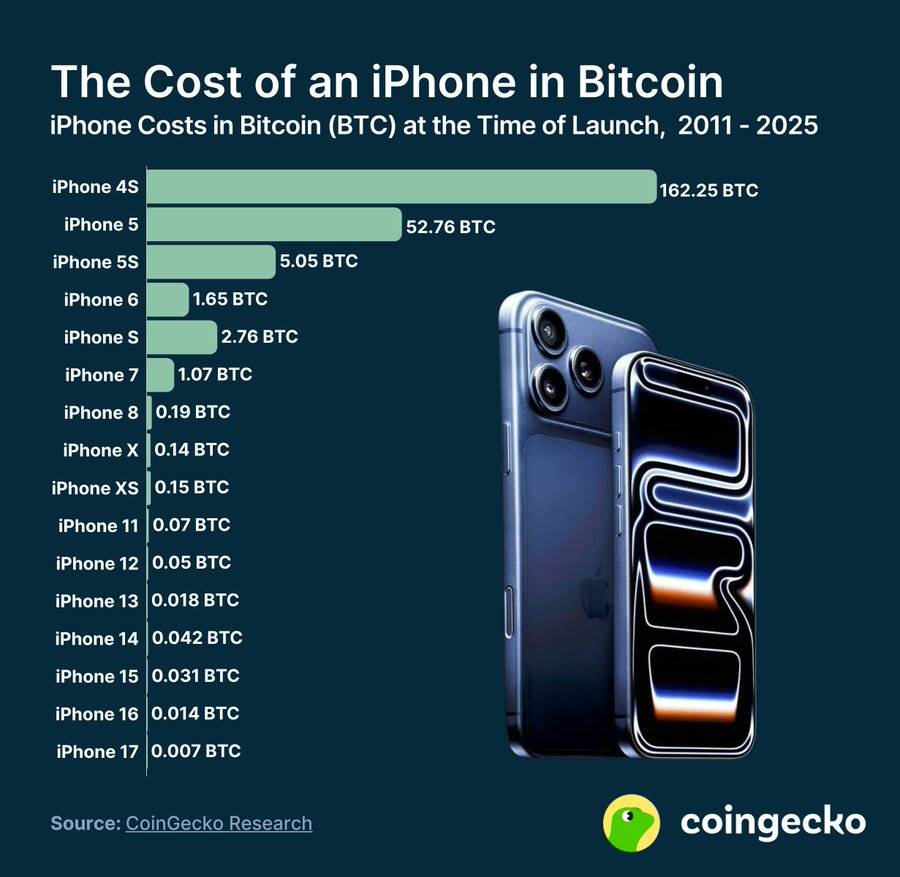

This approach is vital because cryptocurrencies fluctuate wildly, yet history favors endurance. Consider Bitcoin: in 2011, an iPhone 4S equated to about 162 BTC, but today, an iPhone 17 costs roughly 0.07 BTC, illustrating BTC's staggering appreciation. According to CoinGecko data (n.d.), this shift underscores how holding BTC has outpaced consumer goods inflation dramatically.

It's like Apple's iterative upgrades—subtle yet compounding. A whimsical tale: picture choosing 162 BTC over that 2011 iPhone; now, those coins could fetch over a million dollars, while the phone gathers dust. You can begin by selecting a core asset, like BTC, and storing it in a secure cold wallet, vowing to review only annually.

Extending HODLing to Stablecoins and RWAs in Web3

Next, apply this to stablecoins and RWAs. Stablecoins are cryptocurrencies anchored to stable assets, such as the US dollar, offering refuge from volatility. RWAs involve tokenizing tangible items like real estate or bonds on blockchain for enhanced liquidity.

HODLing here means accumulating for yield rather than speculation. For instance, stablecoins like USDC can be lent on DeFi platforms for consistent returns, mirroring Apple's ecosystem retention. A Galaxy Digital report (2024) projects RWAs could mobilize trillions by integrating traditional finance with Web3, rewarding holders with passive income from tokenized treasuries.

Observe this in action: during the 2022 downturn, those who hoarded stablecoins and lent them at 4-7% APY emerged stronger as markets rebounded, much like Apple's steady climb post-recessions. When volatility strikes, try diversifying 30% into RWA-backed stablecoins via protocols like Centrifuge, focusing on audited yields.

Balancing the Hoard: Risks and Realities

However, hoarding demands caution. Over-reliance on any asset exposes you to black swan events, like regulatory clamps or tech failures.

Acknowledge trade-offs: while HODLing sidesteps short-term taxes and panic sells, it may miss diversification gains. Per a World Economic Forum insight (2023), crypto's volatility necessitates balanced portfolios, blending stablecoins for defense with RWAs for growth.

The equilibrium? Limit crypto exposure to 40% of investments, regularly auditing holdings—ensuring your hoard evolves without erosion.

Cultivating Crypto Wisdom with iPhone 17 Insights

In essence, the iPhone 17's launch illuminates Apple thinking as crypto's hoarding ethos, empowering Web3 participants to harness stablecoins for stability and RWAs for expansion, yielding compounded wealth over time. This strategy tempers impulsivity, aligns with decentralized principles, and transforms volatility into opportunity.

Echoing that keynote excitement, remember: lasting value accrues gradually, not in flashes. I'd love to hear your HODLing journeys—share in the comments which stablecoin or RWA you're nurturing, or experiment with this and report back.

References

CoinGecko. (n.d.). Bitcoin Price Chart. https://www.coingecko.com/en/coins/bitcoin

Galaxy Digital. (2024). Real World Assets: The Next Wave of Tokenization. https://www.galaxydigital.io/insights/research/real-world-assets-the-next-wave-of-tokenization

World Economic Forum. (2023). Navigating Crypto Volatility: Strategies for Institutional Investors. https://www.weforum.org/publications/navigating-crypto-volatility-strategies-for-institutional-investors/